Land Tax Rates in Australia

Land tax is a major ongoing cost for property owners, and understanding how it varies across states is essential for investors planning where and how to hold real estate assets. Each state and territory in Australia has its own thresholds, rates, and exemptions — making for significant differences in the total tax paid.

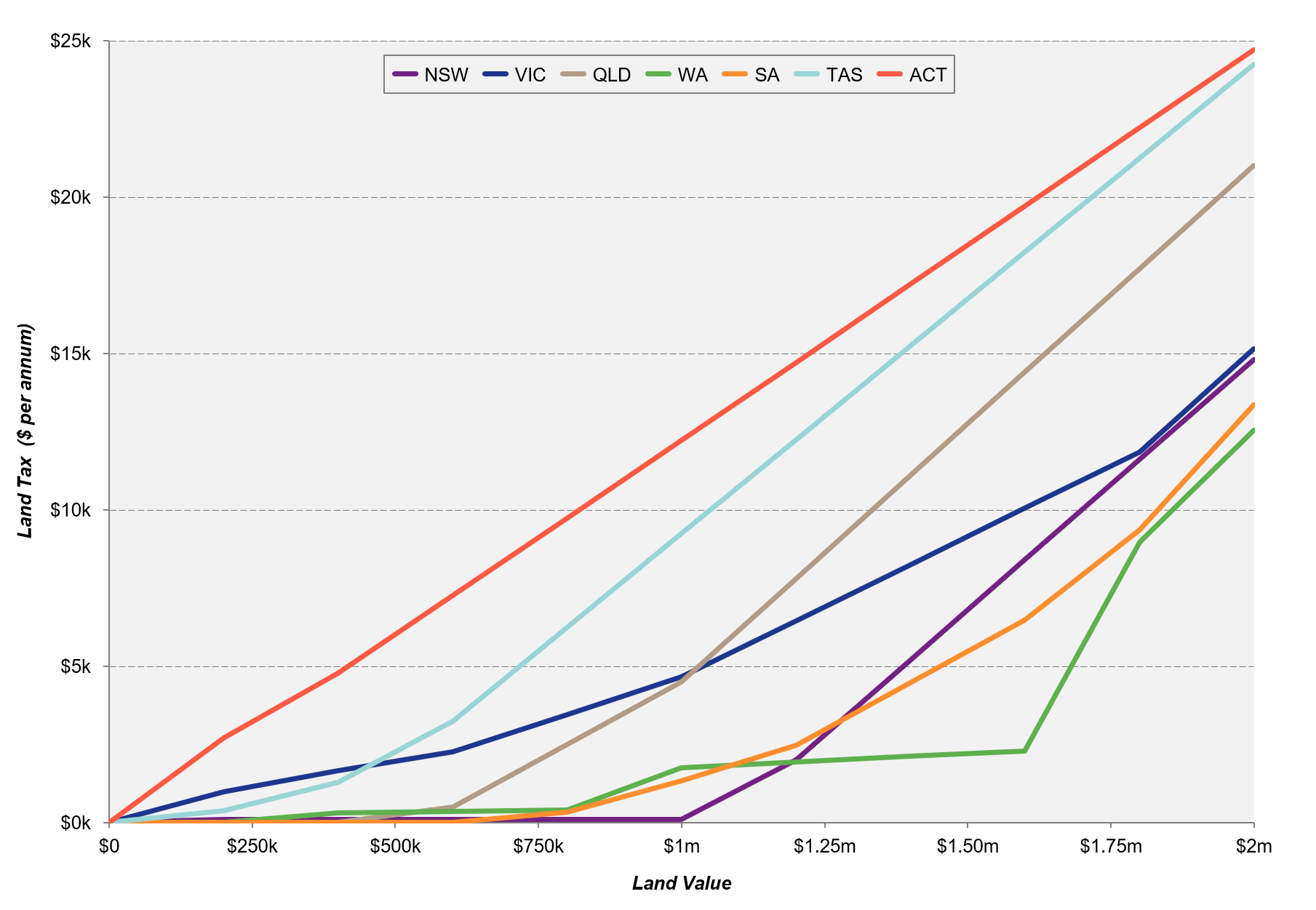

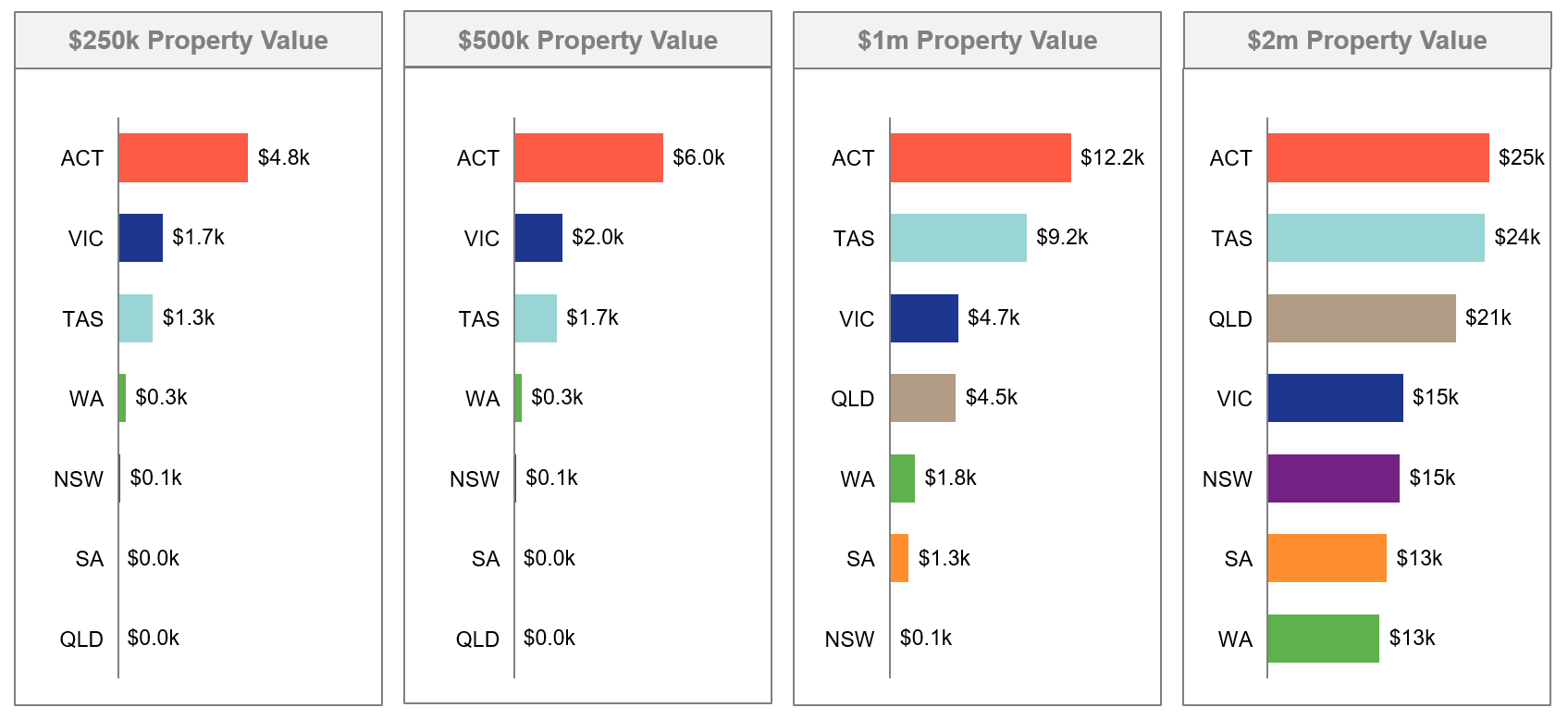

The following visualisations offer two perspectives. How land tax increases with land value (line graph) and How much is paid at fixed land values (bar charts).

📈 Annual Land Tax by State — From $0 to $2 Million in Land Value

Observations:

ACT and Tasmania impose the highest land tax at most value points. ACT’s tax rises sharply and predictably, peaking at $25,000 for $2 million in land value.

Victoria, Queensland, and NSW form the middle tier but diverge as value increases. Victoria climbs steeply past $1.25 million.

WA and SA remain low up to $1 million but accelerate at higher values — particularly SA beyond $1.5 million.

NSW starts low but sharply increases post $1.3 million due to progressive tax thresholds.

📊 Land Tax at Fixed Property Values

$250k Land Value: ACT already charges $4.8k, VIC and TAS impose moderate tax (~$1.7k and $1.3k). WA, NSW, and SA are near zero.

$500k Land Value: ACT hits $6.0k. VIC and TAS increase slightly. QLD and SA remain at zero.

$1m Land Value: ACT leads with $12.2k, TAS $9.2k, VIC and QLD around $4.5k. NSW still negligible.

$2m Land Value: ACT and TAS top out at $25k and $24k, QLD at $21k, VIC/NSW at $15k, and SA/WA at $13k.

🧭 Strategic Implications for Investors

These comparisons reveal that ACT and TAS are the most expensive places to own land, regardless of value.

Victoria also has high property taxes, particularly on lower value holdings below $500k, however land tax amounts are similar to NSW and QLD on higher value properties.

Queensland and NSW sit in the mid-range trending upwards with rising property values.

WA and SA are tax-friendly for holdings under $1m, ideal for small-to-mid investors.

Final Word

Whether you're an individual investor or managing a portfolio, factoring in land tax can dramatically affect your net return. For large-value land, the difference between ACT and WA could be over $10,000 per year. For a full breakdown of thresholds and exemptions in each state, check out our state-by-state land tax guide.